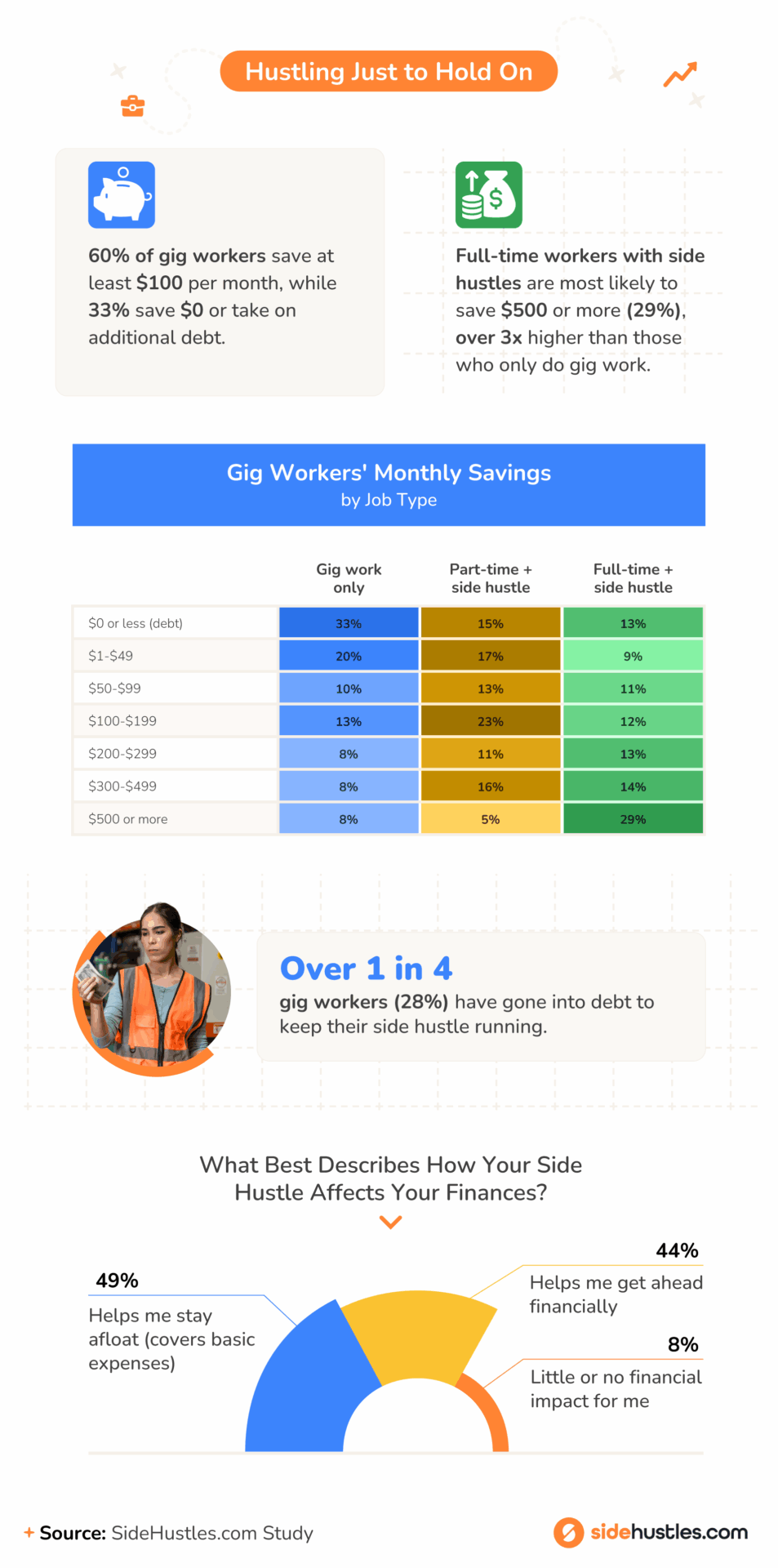

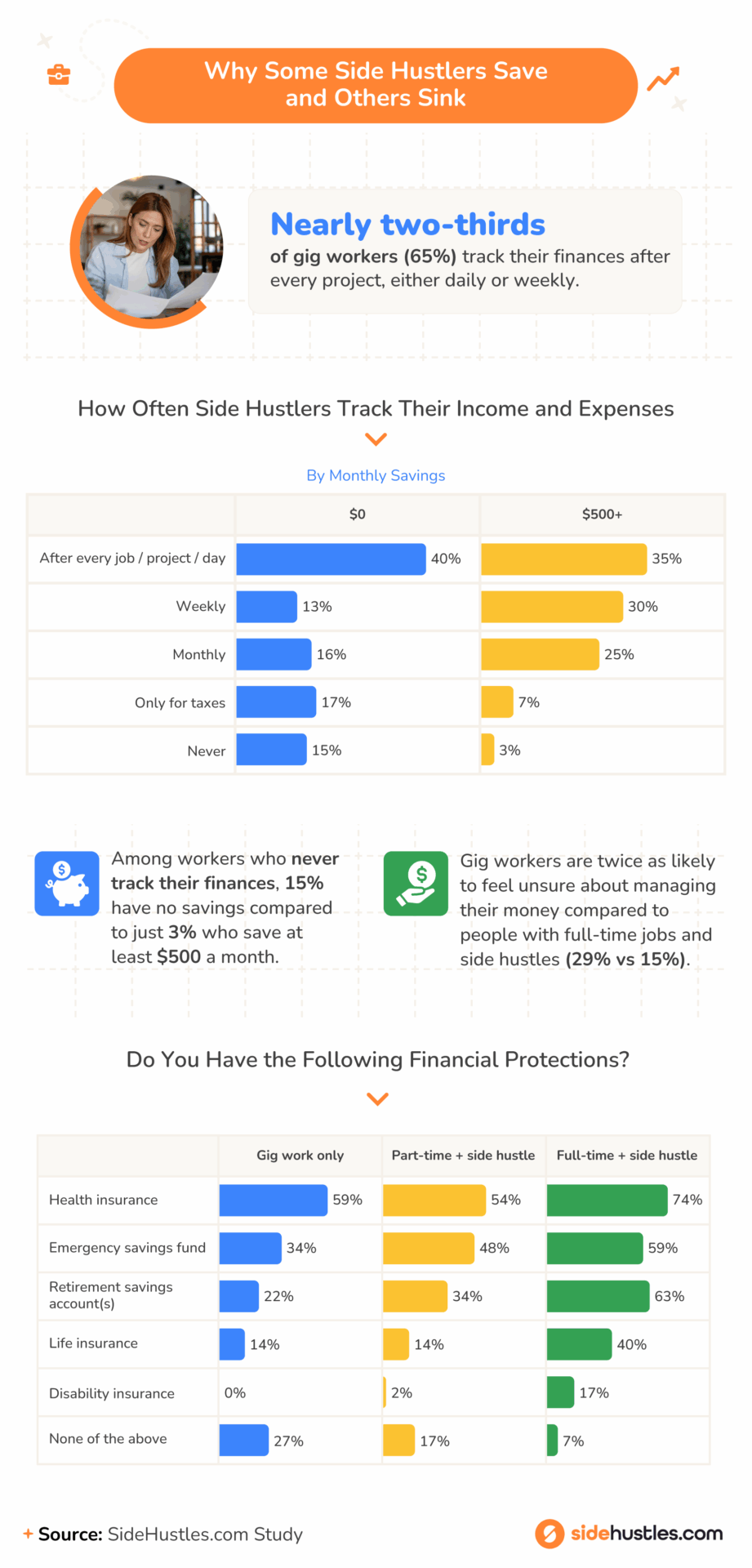

Side hustles have become a lifeline, but for many, they’re not enough to build financial security. A new survey of nearly 1,000 gig workers shows that while most track their earnings closely, 1 in 3 still end up in debt or with no savings at all.

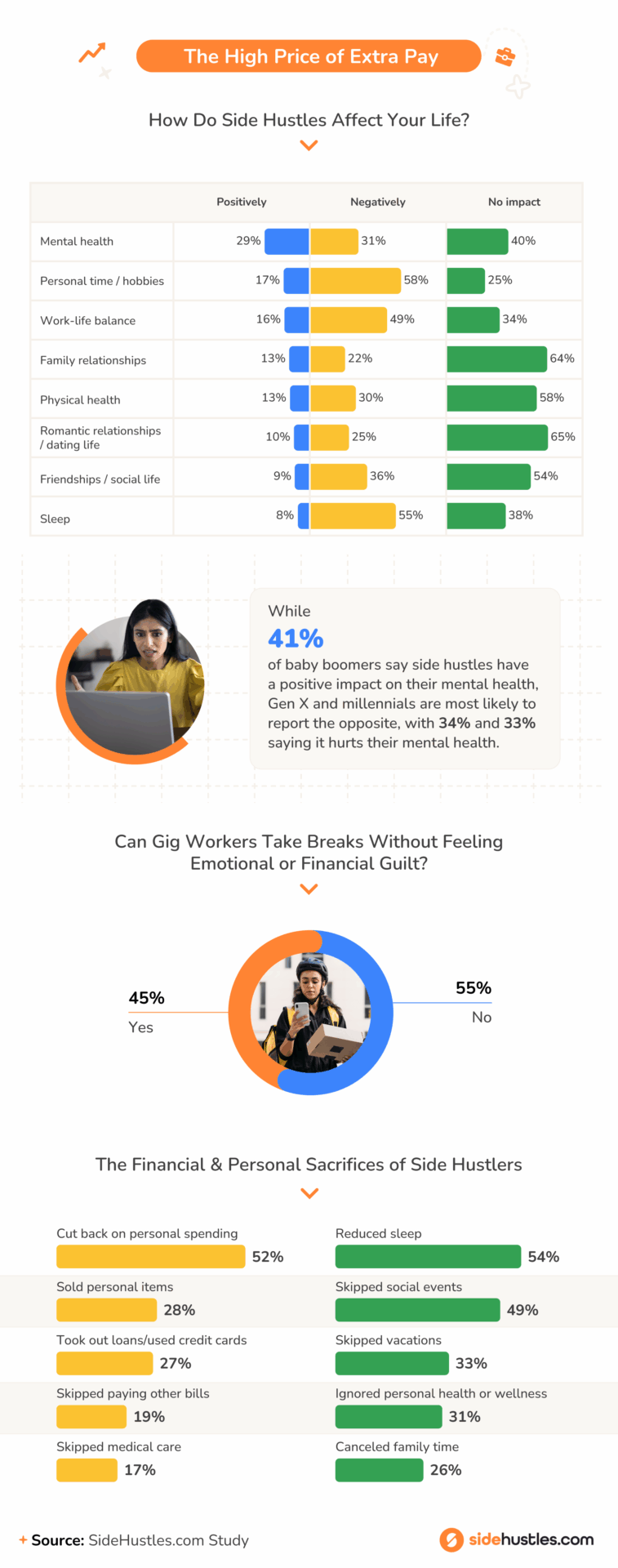

With rising costs and little access to benefits, gig workers often have to build their own safety nets. This study looks at how they’re managing, who’s falling behind, and what it really costs to keep a side hustle going.

Key takeaways

- Nearly half of gig workers (49%) are hustling just to survive.

- Over 1 in 4 gig workers (28%) have gone into debt to keep their side hustle running.

- Full-time workers with side hustles are the most likely to have saved $500 or more per month (29%), over 3x higher than those who do gig work only.

- 1 in 4 gig-only workers have no financial protections at all.

- 55% of gig workers feel guilty taking a break.

Leave a Reply

You must be logged in to post a comment.