We’ve rounded up 17 offers that will reward you with $20 or more when you sign up for various platforms and services, ranging from bank accounts to shopping cashback apps.

01. Can I really get an instant signup bonus of $20?

In theory, there are many ways to get an instant signup bonus of $20 or more. Many companies will give you $20 worth of cash, crypto, gift cards, or similar rewards immediately after you join them as a new customer.

However, although you can sometimes get these types of rewards instantly credited to a new account, in reality, you can’t always use your rewards immediately. Frequently, you’ll have to fulfill specific requirements first, and this process can often take several hours or days—possibly even longer.

For example, you may need to receive a payment to a new account via direct deposit, which will require time to set up the direct deposit (e.g., filling out paperwork), wait for the payment, and then allow for additional processing times. As such, some of the offers on this list will have faster payouts than others, and not all of the services will necessarily suit your lifestyle and needs.

All the same, you should find at least a few offers that will be worth your time. So read on to find out about the best deals offering $20 or more for new signups—and what you’ll need to do to get your bonus.

02. Top 7 places to get an instant signup bonus of $20 or more

If you’re looking for signup bonuses of $20 or more, you can get these from all kinds of places, including cashback apps, banks, and fintech platforms.

The platforms on this list will vary in terms of how fast they’ll pay out your signup bonus, but most of them will do this within a couple of weeks.

However, as we’ve already mentioned, some offers will have complicated hoops for you to jump through in order to qualify for their respective signup bonuses, so this process may also take you extra time.

For example, if you have to receive a direct deposit (e.g., usually your monthly salary from an employer or government benefits) to an account associated with a signup offer, the process of setting this up can take as little as a day or as long as several weeks, depending on payment schedules and other factors.

1. Current

Current is a fintech company offering mobile banking services that include spending accounts, credit cards, credit-building tools, crypto trading, and more. It’s also sometimes described as a “neobank,” which is a type of digital-only bank that operates entirely online.

The platform offers a $50 bonus for new users who sign up for an account (using the promo code on the Current website) and use their account to receive a qualifying direct deposit. To qualify, deposits must be at least $200, and they must reach your account within 45 days.

Once you tick all of these boxes, Current says it will send your bonus within 10 days.

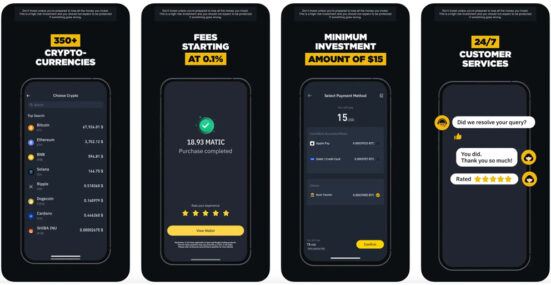

2. Binance

Binance is a different type of fintech platform—this time one you can use to buy, sell, and trade a wide variety of digital currencies, including Bitcoin (BTC), Ethereum (ETH), and many more.

Binance

Minimum Deposit ~$10

Commission ~0.1%

Withdrawal Method Crypto wallet, bank transfer, or Visa card

Account Fee None

More information

-

Signup Bonus

Earn cryptocurrency worth $100 when you sign up and buy $100 of USDT.

-

Signup Requirements

US users must be at least 18 years old and have a valid Social Security number (SSN), home address, and email address.

-

Investment Options

Buy and sell cryptocurrencies on Binance.

When you sign up to use Binance, you can get a bonus of up to 100 USDT if you follow the platform’s signup instructions. USDT is a type of cryptocurrency known as a stablecoin, which is designed to maintain a value of 1 USDT = 1 US dollar. This means its value doesn’t go up and down as much as other cryptocurrencies’.

To qualify for the offer, you will have to deposit at least 100 USDT into your Binance account, and Binance says it will add the welcome bonus to your account automatically once the deposit is confirmed.

This is potentially one of the fastest ways to get a signup bonus, but the exact time it takes will depend on various factors, including the time it takes Binance to verify your identity when you open your account (usually 1–2 business days at most), the time it takes for your deposit to reach your new Binance account (a few days at most), and other processing times.

However, Binance says that you may need to fulfill certain requirements (e.g., reaching a minimum trading volume or maintaining your account for a certain period of time) before you can withdraw your bonus. The FAQs page on Binance’s website has more information about withdrawals.

3. SoFi Checking and Savings accounts

SoFi is a personal finance and fintech company that offers credit cards, mortgages, loans, stock investing, and other financial tools and services.

SoFi Checking and Savings account

Signup bonus $50–$300

Rewards Cash back + interest-earning features

Monthly fees None

ATM fees None (but third-party fees may apply)

More information

-

Signup Bonus

Earn $50–$300 after setting up direct deposit and meeting the deposit amount threshold.

-

Other notable fees

$20 fee for outgoing wire transfers.

-

Withdrawals

Withdraw cash via SoFi debit card at ATMs, ACH transfers, and peer-to-peer apps (e.g., Venmo, PayPal).

SoFi started life as a provider of student loan refinancing and then branched out into other financial sectors. Like Current, it could be categorized as a neobank—with its digital-first approach and app-based services—although it technically qualifies as a fully fledged bank.

When you open a new SoFi Checking and Savings account online and use it to receive a direct deposit of at least $1,000, you can earn $50–$300 as a welcome bonus. The exact bonus amount will depend on the direct deposit amount you receive. 1

However, although this bonus is decent, the payout speed will depend largely on how long your direct deposit takes to set up (which will depend on your payer, along with other factors). SoFi warns that setting up direct deposits can take 2–4 weeks. Once the deposit money materializes, your bonus will follow within a week. 1

4. Chase

Chase is a major bank and one of the largest financial institutions in the US. It offers many different banking services, including personal banking, business banking, credit cards, loans, and investment services.

Chase

Signup bonus $100+

Rewards Cash back + interest-earning features

Monthly fees $0–$35

ATM fees $0–$5

More information

-

Signup bonus

Earn $100+ when you open a Chase account or credit card and meet additional criteria.

-

Other Notable Fees

Overdraft fee of $34, monthly service fees on some checking and savings accounts, and annual fees on many credit cards.

-

Withdrawals

Withdraw via ATMs, online transfers, branch visits, or debit/credit card purchases.

At the time of writing (May 2025), Chase also has multiple offers with welcome bonuses of $100 or more. For example, Chase’s checking account or credit cards often come with these types of bonuses for new users.

The caveat is that you will usually have to fulfill many specific requirements to qualify for these. For example, you may need to receive direct deposits that exceed a certain threshold, pass credit checks, or meet other criteria. There may also be fees or other charges to watch out for (which you can research on the Chase website).

Some offers will also be faster than others in terms of how quickly you can cash out your bonuses (which could take anything from a few days to a few months), so this is another thing to research in advance.

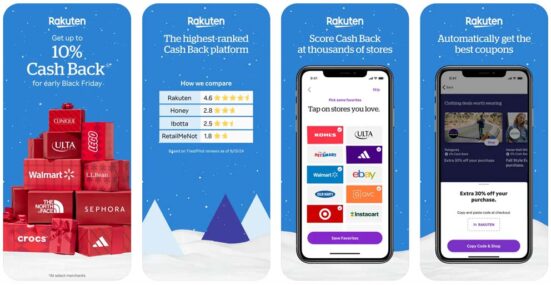

5. Rakuten

Rakuten is a type of cashback app, and it’s among the most popular ones available. You can use it to get small amounts of money back on purchases you make via the Rakuten.com website, the Rakuten app, or the browser extension.

Rakuten

Rewards Type Cash, Amex rewards, or check

Rewards Rate 1%–15%

Fees $2/month for inactive accounts

Withdraw Minimum $5.01

More information

-

Signup Bonus

Earn $10 when you sign up and meet spending requirements (a qualifying purchase of $25+ within 90 days).

-

Earning Method

Make qualifying in-store purchases (with a linked credit card) and online purchases through Rakuten.

-

Payment Options

Withdraw earnings via check, PayPal, or American Express Membership Rewards points.

The platform also has a $20 signup bonus for new users who shop through their portal and make a qualifying purchase of $25+ within 90 days. Because you have to spend money for this offer, it’s more of a signup discount than a signup bonus. However, if you have a preplanned purchase you can make via Rakuten, it’ll be worth taking advantage of this offer.

Rakuten says it will send your first payment as soon as 15 days after your first purchase. This means a bit of a delay is likely to get your signup bonus rewards. However, it shouldn’t take too long.

After the first payment, Rakuten pays users at the following set times:

- February 15

- May 15

- August 15

- November 15

Rakuten also offers several payment method options (check, PayPal, or American Express Membership Rewards points).

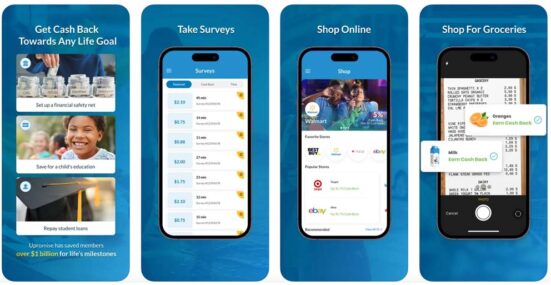

6. Upromise

Upromise is a free rewards program designed to help families save for college by earning cashback rewards from everyday activities like shopping, dining, and traveling.

Upromise

Rewards Type Cash

Rewards Rate 1.25%–1.529%

Fees None

Withdraw Minimum $10 (bank transfer) or $50 (529 account transfer)

More information

-

Signup Bonus

Earn $30.29 ($5.29 when you verify your email + $25 when you link Upromise with a financial account).

-

Earning Method

Earn with purchases via Upromise (from participating merchants), spending on debit or credit cards linked to Upromise, surveys, and games.

-

Payment Options

Withdraw earnings via direct deposit.

You can use the platform by linking a 529 college savings plan, student loan account, or regular bank account to your Upromise account. Then, when you shop through the Upromise portal, visit participating restaurants, or use a linked card at partner retailers, you’ll earn cash back rewards on your purchases. There are also other ways to earn, including surveys and games.

Upromise automatically transfers the rewards you earn to the account you link with the platform, which generally happens during the first week of each month. Upromise says transfers usually take less than a week to complete (although it could take up to 45 days for some 529 Plan account payments), so, for most types of accounts, the bonus payment should reach you pretty fast. 2

Currently, you can get a bonus of $5.29 when you verify your email on Upromise. Even better, you’ll get another $25 when you link your Upromise account with any financial account.

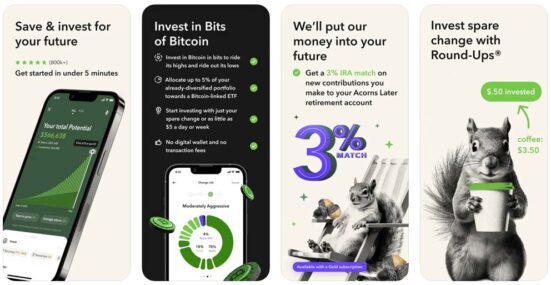

7. Acorns

Acorns is a type of fintech app built on the principles of “micro investing,” which is a way of investing in small increments by buying fractions of shares. It’s one of several platforms on this list that are designed to help you invest money in various ways; these are often called brokerage apps or trading apps.

Acorns

Minimum Deposit $5

Commission None

Withdrawal Method ACH transfers

Account Fee $1–$12 / month (+ 0.25% / month on large balances)

More information

-

Signup Bonus

Earn $25 after signing up and meeting requirements for a minimum investment.

-

Signup Requirements

You must be at least 18 years old, be a US citizen or permanent resident, and have a valid Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN).

-

Investment Options

Buy and sell stocks, ETFs, and bonds.

Acorns currently has a $25 bonus for new users who sign up. Additional requirements apply, as you’ll need to make a recurring payment into an Acorns account, and this must exceed a minimum threshold (at least $5 per day, week, or month).

Any bonuses you receive will be in the form of Reward Shares invested into your account, where Reward Shares are fractions of ETF shares or stocks (and ETFs—or exchange-traded funds—are investments that combine stocks or other assets to spread risk).

If you want to turn your shares into cash, it could be a few weeks before you get your hands on the money. Acorns says that typically pays bonuses within 10 days of the following month after you make your first successful Recurring Investment. 3

03. $20 signup bonus offers that may take longer to reach you

The companies on this list offer signup bonuses of $20 or more, but these bonus rewards won’t necessarily reach you quickly. You could be waiting anywhere from a few days to several months to receive the fruits of these offers, so check the terms and conditions carefully before you sign up for anything.

8. Upgrade Rewards Checking Plus

Upgrade joins the ranks of the neobanks in our list, offering digital banking and credit products through their digital platform, which operates entirely online.

Upgrade Rewards Checking Plus

Signup bonus $200

Rewards Cash back

Monthly fees None

ATM fees $0–$2.50 per transaction (plus third-party fees)

More information

-

Signup Bonus

Earn $200 when you make your first three debit card transactions.

-

Other notable fees

3% foreign transaction fee on debit card purchases outside the US; $20 fee for outbound domestic wire transfers after the first free transfer each month.

-

Withdrawals

Withdraw via Upgrade Visa® debit card at ATMs, purchases at merchants, and electronic transfers to external bank accounts.

Upgrade offers a $200 bonus when you open a Rewards Checking Plus account and use it to make three debit card transactions. 4

However, once again, the bonus payment for this platform isn’t guaranteed to be fast. In fact, it could take up to a couple of months, as Upgrade says that it will pay the bonus into your Rewards Checking Plus account within 60 days after you fulfill the requirements (so you’ll have to make three debit card transactions first).

Although there’s a chance the payment will reach you in much less than 60 days, you shouldn’t count on this.

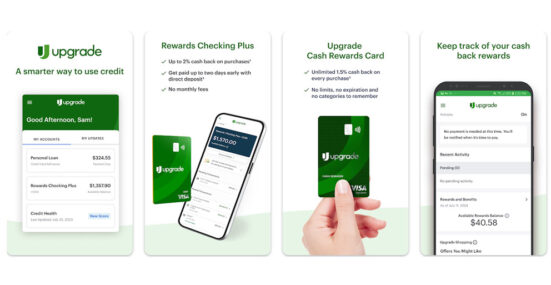

9. TradeStation

TradeStation is another investment platform that allows users to trade shares, ETFs (exchange-traded funds, which group lots of companies together in a combination of stocks or other assets), options (contracts that let you buy or sell stocks at a set price at certain times), crypto, and other assets.

TradeStation

Minimum Deposit $0

Commission $0–$5

Withdrawal Method ACH or wire transfer

Account Fee $0–$149.95/month

More information

-

Signup Bonus

Earn $150–$3,500 when you sign up and meet the qualifying deposit requirements.

-

Signup Requirements

You must be at least 18 years old and have a valid government-issued ID or driver’s license.

-

Investment Options

Buy and sell stocks, ETFs, options, futures, crypto, and more.

It’s similar to Robinhood (another widely used investment app that appears later on this list) but is more geared toward experienced investors. It offers a very generous welcome bonus, but one that will take a long time to reach you.

When you sign up with TradeStation, it will give you $150–$3,500 in the form of a cash credit deposited directly into your account. However, as with the signup offer for the Public investment app, you’ll need at least $5,000 in savings or investments you can transfer to TradeStation in order to get this bonus. The more you deposit, the bigger your bonus will be.

After that, TradeStation says that it will deposit the cash into your account the month after a 270-day holding period. In other words, you must keep your deposit in your account for about 9 months to qualify for the bonus cash, which will usually come in the month following the end of the holding period.

To get the TradeStation signup bonus, you’ll need to use the promo code that TradeStation provides on its website and, as mentioned, fund your account with $5,000 or more (then maintain your balance for 270 days).

Use a promo code to get the TradeStation signup bonus

04. Platforms that sometimes offer $20 signup bonuses

This list features investment platforms, banking services, cashback apps, and other apps that sometimes give new users a signup bonus of $20 or more.

Unfortunately, these companies don’t always guarantee a signup bonus, and some offers we’ve found may expire relatively fast. However, we’ve included them on our list, since there’s a good chance that expired offers will be replaced with new ones at some point.

In terms of how long these platforms will take to give you your bonus, the timelines will vary from as little as an hour to several months or even more.

Sometimes, companies provide conservative estimates regarding timelines for payments (meaning that there’s a decent chance of getting bonuses long before cited deadlines). However, for some finance-related apps on our list—including some we’ve already mentioned—you have to keep a certain amount of cash in an account for several weeks or even months before you can get your welcome bonus.

10. Freecash

Freecash is a type of platform often called a microtasking or GPT (get paid to) platform. You can use it to earn money by playing games, testing apps, and completing surveys.

Freecash

The Verdict

Freecash is a globally available platform that will pay you for testing games. It claims to offer instant redemption when you withdraw cash (except via bank transfer, which may take several days).

Signup Bonus $0.05–$250

Withdraw Minimum $5–$20 (then $0.25)

Time to Cash Out Not yet tested

Usability Not yet tested

The Verdict

Freecash is a globally available platform that will pay you for testing games. It claims to offer instant redemption when you withdraw cash (except via bank transfer, which may take several days).

More information

-

Signup Bonus

$0.05–$250 after signing up.

-

Redemption Options

Withdraw earnings via PayPal, bank transfer, gift cards, prepaid debit cards, crypto, or several other methods.

-

Task Variety

Earn by playing games, completing surveys, completing offers, and downloading other non-gaming apps.

Freecash is available in the form of an app for Android devices or a web-based version for internet browsers. Although there’s no iOS app (for iPhones and iPads), you may be able to earn rewards for downloading some iOS apps via the Freecash website.

The welcome bonus situation with this platform is complicated, as the potential bonus amount will depend on various factors (which Freecash doesn’t explain very clearly). If you get a bonus, it will be between $0.05 and $250, but you’re more likely to get something at the lower end of that range. Similarly, the minimum withdrawal amount will vary but will be between $5 and $20. 5

However, the great part about this particular signup bonus offer is that Freecash offers instant withdrawals. If your withdrawal threshold is $5—or another amount low enough that you can reach it relatively fast—this platform provides one of the fastest routes to getting a signup bonus and cashing out; it’s just that the bonus isn’t guaranteed to reach $20.

11. Public

Public is an investment app for trading stocks, bonds, crypto, ETFs (exchange-traded funds), options (which you can use to trade assets at set prices at certain times), REITS (real estate investment trusts, which are companies that own or finance income-generating properties), and other types of assets.

Public

Minimum Deposit $20

Commission None

Withdrawal Method ACH transfers

Account Fee None (for basic account)

More information

-

Signup Bonus

Earn $150–$10,000 after opening an account and funding it with $5,000–$5,000,000.

-

Signup Requirements

You must be at least 18 years old, a US citizen or legal resident, and have a valid Social Security number (SSN).

-

Investment Options

Buy and sell US stocks, options, bonds, ETFs, cryptocurrencies, and more.

To get the Public signup bonus, you’ll need a pretty hefty amount of money to deposit in one of their accounts. This may be a good option if you already have funds earmarked for investment.

The Public signup offer promises cash bonuses of $150–$10,000 to new users who open an account and fund it with $5,000–$5,000,000. The exact amount of the bonus depends on how much you put in your account (with larger bonuses for larger investments).

Public says that it will pay the cash bonus within a month after the transfer, and there are also other important terms and conditions to consider. Notably, they threaten to revoke the bonus if you don’t keep the money in your account for at least 5 years.

Although this offer is available at the time of writing (May 2025), it won’t necessarily be around for a long time. However, Public may follow it up with other, similar offers to entice new users away from bigger platforms like TradeStation and Robinhood (which is next on our list).

12. Robinhood

Robinhood is a very popular investment platform you can use to buy shares, ETFs, options, REITs (real estate investment trusts), crypto, and other types of assets.

Robinhood

Minimum Deposit $1

Commission None

Withdrawal Method ACH transfers or debit card

Account Fee $0–$5 / month

More information

-

Signup Bonus

Earn free stock worth $5–$200 when you sign up and transfer funds.

-

Signup Requirements

You must be at least 18 years old, be a US citizen or permanent resident, have a valid Social Security number (SSN), and have a legal residential address.

-

Investment Options

Buy and sell stocks, ETFs, options, crypto, and more.

They also offer a signup bonus for new users of the platform in the form of free stocks. However, this bonus isn’t likely to be worth more than $20; rather, Robinhood says that the value will be equivalent to “a specified dollar amount anywhere between $5 and $200” and that approximately 99% of customers will get stock worth $5. 6

Also, this signup bonus offer will give you quick rewards, but you can’t turn these into quick cash; Robinhood says that you must wait 30 days to withdraw cash from your Robinhood account. 7 However, if you want to use the bonus money to buy other assets, you can do this before the 30-day mark.

Robinhood says you have to claim your bonus within 60 days. After that, if you want to sell your stocks to get cash, you must wait at least another three days.

You’ll have to manually claim your Robinhood bonus

13. E*TRADE

E*TRADE is yet another popular investment platform, this time owned by the global investment bank and wealth management firm Morgan Stanley.

E*TRADE

Minimum Deposit $0

Commission From $0

Withdrawal Method ACH transfer, wire transfer, check, or E*TRADE debit card

Account Fee $0–$15 / month

More information

-

Signup Bonus

Earn $50–$10,000 after signing up and depositing $1,000 or more.

-

Signup Requirements

You must be a US citizen or legal resident aged 18 or older, provide personal and financial information including a valid Social Security number (SSN), and complete an online application (with no minimum deposit required).

-

Investment Options

Buy and sell stocks, bonds, ETFs, futures, options, and more.

It offers many of the investment services you’ll see on other platforms, such as stocks, bonds, ETFs, options, futures (contracts that commit you to buy or sell stocks or other assets at a set price on a specific future date), and mutual funds (which can contain a mix of stocks, bonds, or other assets).

E*TRADE also currently has a promo offer for new signups, offering $50–$10,000 in cash credits when you open a brokerage account and invest $1,000 or more. The more you invest, the more cash credits you’ll get.

Unfortunately, this offer doesn’t promise instant cash in most cases. If you invest less than $200,000, you’ll have to wait at least two months (60 days) from the date you open your account to get your bonus.

Also, this particular signup bonus offer is temporary. However, if you miss out this time, it will likely be followed up with other similar offers.

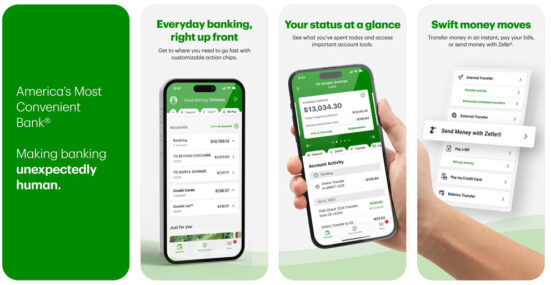

14. TD Bank

TD Bank is a Canadian bank that operates in the US via physical branches as well as digital services. They offer banking services, credit cards, loans, home lending, and other financial products.

TD Bank

Signup bonus Up to $2,400

Rewards Interest

Monthly Fees $0 (basic)

ATM fees $0–$3

More information

-

Signup Bonus

Earn up to $2,400 when you sign up and meet requirements (e.g., deposit thresholds).

-

Other Notable Fees

Overdraft fees may apply.

-

Withdrawals

Withdraw via TD Bank ATMs purchases, online transfers, or by visiting a branch.

TD Bank often has welcome bonuses for new customers, with various bonus amounts available, depending on the type of account you get. For example, at the time of writing (May 2025), you can get bonuses of $200–$300 when you sign up for their checking or savings account.

However, many of these signup offers entail a potentially long wait for your bonus rewards to reach you. For example, many of the offers we saw involved a wait of up to 180 days (6 months).

Many offers also have specific requirements. For example, only certain types of users may be eligible, or you may need to use the account for qualifying direct deposits or maintain a minimum balance in a new savings account for a set period.

Because some TD Bank offers are also short-term, you’ll need to review their website to find out what’s available at the time you plan to sign up. It’s likely they’ll have ongoing offers to entice new users away from their competitors like Chase.

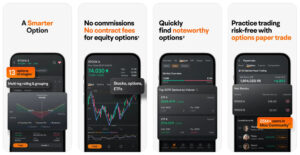

15. MooMoo

MooMoo is another beginner-friendly trading platform similar to Robinhood. It offers commission-free trading for shares, ETFs, options, REITs (real estate investment trusts), and other types of assets.

MooMoo

Minimum Deposit $0

Commission $0

Withdrawal Method ACH and wire transfer

Account Fee $0

More information

-

Signup Bonus

Earn $10–$120,000 worth of free stocks when you sign up.

-

Signup Requirements

You must be at least 18 years old, reside in a supported country or region, and provide valid identification and proof of address during the online application process.

-

Investment Options

Buy and sell stocks, ETFs, options, crypto, and more.

At the time of writing, MooMoo has an offer of free stocks for new customers who open an account with them and deposit at least $100 in the account.

However, if you deposit just $100, you’re only guaranteed $10 worth of bonus stocks, although you have a chance to win more (with up to $120,000 worth of free stocks up for grabs if you deposit more than $5,000 in your MooMoo account and get unbelievably lucky).

As usual, there are various terms and conditions you’ll need to fulfill to benefit from this signup bonus offer. And, though you can get the stocks immediately (which you’ll need to do by claiming them manually when MooMoo sends you an in-app notification), you won’t be able to unlock them until you’ve maintained your deposit money in your account for 60 days.

MooMoo doesn’t currently offer crypto trading in the US

Although MooMoo doesn’t currently offer crypto trading in the US, it does offer these services in Singapore. This suggests that crypto is likely to be available later on in the US, too.

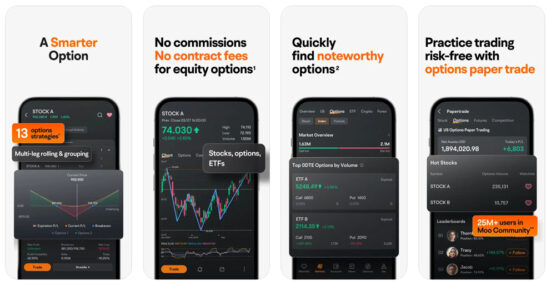

16. Ibotta

Ibotta is a receipt-scanning and cashback rewards app that has been around since 2012. 8 It began in the windowless basement of an old fire station in downtown Denver and has now grown into one of the most popular cashback apps in the US.

Ibotta

Rewards Type Cash or gift cards

Rewards Rate Varies

Fees $3.99/month for inactive accounts

Withdraw Minimum $20

More information

-

Signup Bonus

Earn a small amount of cash when you sign up with the app for the first time and fulfil other potential requirements (e.g., minimum spending).

-

Earning Method

Submit receipts for eligible purchases online; shop through the Ibotta website, app, or browser extension; or shop in eligible stores with loyalty cards linked to Ibotta.

-

Payment Options

Withdraw earnings via deposit to your bank account, PayPal, or gift cards.

To qualify for Ibotta welcome bonuses, you have to redeem a certain number of offers. The bonus situation is a little confusing, as reports vary regarding how much you’ll get (and Ibotta doesn’t confirm the bonus amount, so it may depend on your location or other variables).

Some sources suggest that you can sometimes get up to $20. However, we haven’t managed to confirm that, and other anecdotal reports claim that you’ll likely get less.

Ibotta claims that any money you withdraw from the app (which you can do via PayPal) will usually reach you within an hour. As such, it offers one of the fastest payouts among the apps on our list. 9

17. Receipt Hog

Receipt Hog is another popular receipt-scanning app that promises “a fun and rewarding way to turn receipts from everyday shopping into cash.” You can use it for both digital and paper receipts, and it also sometimes has surveys and other tasks.

Receipt Hog

Rewards Type Cash or gift cards

Rewards Rate 2.5¢–12.3¢ / receipt

Fees None

Withdraw Minimum $5

More information

-

Signup Bonus

Earn <$1 (plus chances to win credits) when you sign up.

-

Earning Method

Submit a receipt for an eligible purchase through the app, and complete in-app surveys.

-

Payment Options

Withdraw earnings via PayPal, Amazon gift cards, or Visa.

Once again, the bonus situation is a little ambiguous with this app. It says it will give you a bonus to connect your email account to your Receipt Hog account, but the information it provides about the bonus amount is confusing, as it’s not clear whether the bonus is worth 36 coins or 100 coins (or if you will receive both amounts).

Every Receipt Hog coin is worth roughly half a cent, so the bonus will ultimately be worth less than a dollar.

The platform also promises free sweepstakes entries for users who connect their email accounts, meaning that there’s a chance you’ll end up with a sweepstakes prize of around $0.25–$25.00 as a reward for signing up. However, we suspect that your chances of winning $20 or more are slim.

On the upside, cashing out on Receipt Hog (which you can do via PayPal, Visa, or Amazon gift cards) is likely to be fairly fast, albeit not instant. Receipt Hog says that once you cash out, they will review and approve your redemption request within 7 days of your request date.

05. How to get an instant $20 bonus with referrals

In addition to signup bonuses, referral bonuses are a great way to get cash or other freebies worth $20 or more.

You can get referral bonuses when someone who is already using a service recommends you as a new user or, vice versa, when you recommend other new users to a service you’re already using.

Platforms and services that often offer referral bonuses include:

- Digital payment platforms: Venmo, PayPal, and Cash App are three popular payment platforms that frequently offer referral bonuses.

- Digital banking services: You may find offers from the likes of Revolut, Chime, and Wise.

- Brokerage apps: We’ve already mentioned a few investment platforms and brokerage apps that may offer referral bonuses as well as signup bonuses. You can also try alternatives like Webull and SoFi (which offers investment services).

- Crypto apps: Check out crypto-specific trading apps like Coinbase and Crypto.com.

- Other fintech apps: Try EarnIn (a payday app), Albert (a personal finance app), and MoneyLion (an all-in-one platform for mobile banking, cash advances, credit-building loans, and investing tools).

- Microtasking platforms: There are numerous websites and apps for earning with microtasking, which involves completing quick and easy tasks for cash and other rewards. Popular examples include InboxDollars (which you can read about in our InboxDollars review), Swagbucks (which we also reviewed), and Branded Surveys (which we also reviewed).

If someone refers you to a platform or service that has a referral bonus, they’ll usually have to give you a special link or code. If you don’t know anyone who is already using the company you have in mind, you may be able to ferret out links or codes online (e.g., via social media or reviews).

Similarly, you can share your own referral links and codes online to earn bonuses by referring other people to join a platform you’re using.

06. Other ways to get $20 fast

Signup bonuses are one way to make a quick buck, but there are many more strategies you can use to earn $20 fast, including ways to make money in one hour or less.

- Microtasking: Many survey platforms and microtasking or GPT platforms offer $1–$10 bonuses when you sign up, and you may then be able to reach the $20 mark within a few hours by taking surveys, playing games, exploring deals, and completing other quick and easy tasks. Besides the popular platforms we’ve already listed, you can try Mistplay (a gaming app), Scrambly (a GPT app), and MTurk (which you can read about in our MTurk review).

- Freelancing: There are also many popular freelancing platforms you can use to find work (including remote work) in all kinds of areas, such as writing, proofreading, graphic design, and virtual assistance.

- Selling stuff online: If freelancing sounds like too much effort, there are many more ways to make money selling items online. Numerous selling platforms exist for this purpose, such as Facebook Marketplace and eBay.

- Renting stuff out: If you don’t have anything you want to sell outright, you might have something you can rent out to make money. Consider renting out spare rooms, vehicles, bikes, sports equipment, or tools, for example.

- More conventional side hustles: There’s a lot to be said for old-fashioned earning strategies like babysitting, mowing lawns, or offering other services to neighbors or people in your local area. You can likely earn $20 from just a couple of hours’ work with this method, and it might pay faster than many of the signup bonus offers we’ve listed (especially if you can get paid in cash).

- Combining multiple offers: Some platforms similar to those we’ve explored have smaller signup bonuses (i.e., $0.01–$19.99). Try stacking these to accumulate $20 or more. For example, the trading and investment platform eToro sometimes has a $10 crypto bonus for certain new users, and you can combine this with another offer, such as the one for BeFrugal, a cashback app that gives new users a $10 bonus when they earn at least $20 in cash back.

Article Sources

- SoFi. "$300 Direct Deposit Welcome Offer" Retrieved June 9, 2025.

- Upromise. "How do I transfer my rewards?" Retrieved June 9, 2025.

- Acorns. "Get a $25 bonus investment when you start saving & investing with Acorns" Retrieved June 9, 2025.

- Upgrade. "Upgrade Card" Retrieved June 9, 2025.

- Freecash. "Your First Withdrawal on Freecash: Requirements & Guide" Retrieved June 9, 2025.

- Robinhood. "Earn 5% APY On Your Cash" Retrieved June 9, 2025.

- Robinhood. "When can I get cash from selling reward stock?" Retrieved June 9, 2025.

- Ibotta. "About Ibotta" Retrieved June 9, 2025.

- Ibotta. "Help: I did not receive my Ibotta payment to my PayPal." Retrieved June 9, 2025.

Leave a Reply

You must be logged in to post a comment.