Side hustles have become increasingly popular. But how do people manage the extra income they earn? Our recent survey of 1,005 Americans with side gigs offers insights into spending habits, savings goals, and financial management across generations. Whether you’re a seasoned side hustler or considering starting your own gig, this study offers valuable insights into the modern gig economy.

Key takeaways

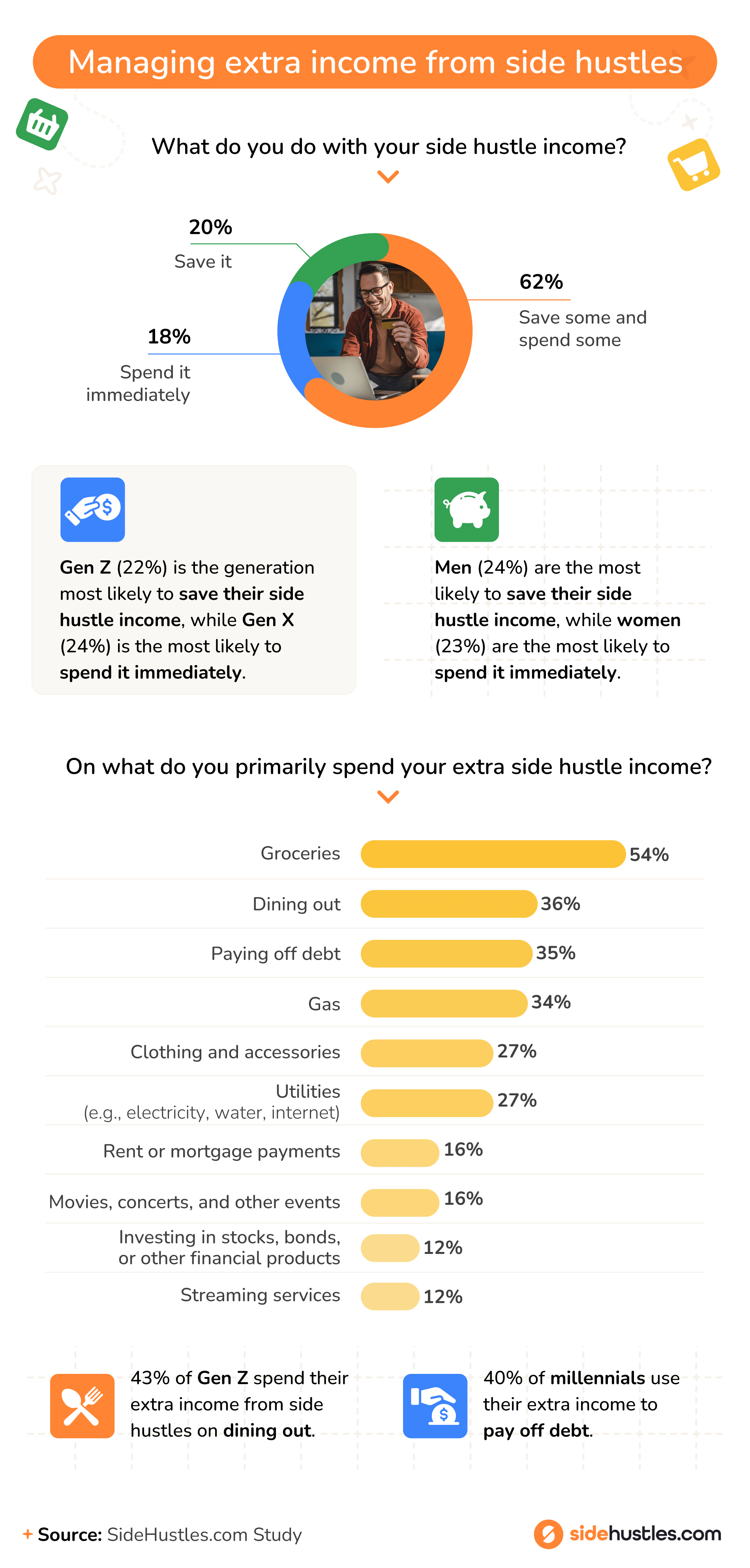

- Nearly 1 in 5 side hustlers spend all their side hustle income immediately, with Gen X (24%) being the most likely to do so.

- Gen Z (22%) is the most likely to save all their side hustle earnings.

- 43% of Gen Z spend their extra income from side hustles on dining out, while 40% of millennials use their extra income to pay off debt.

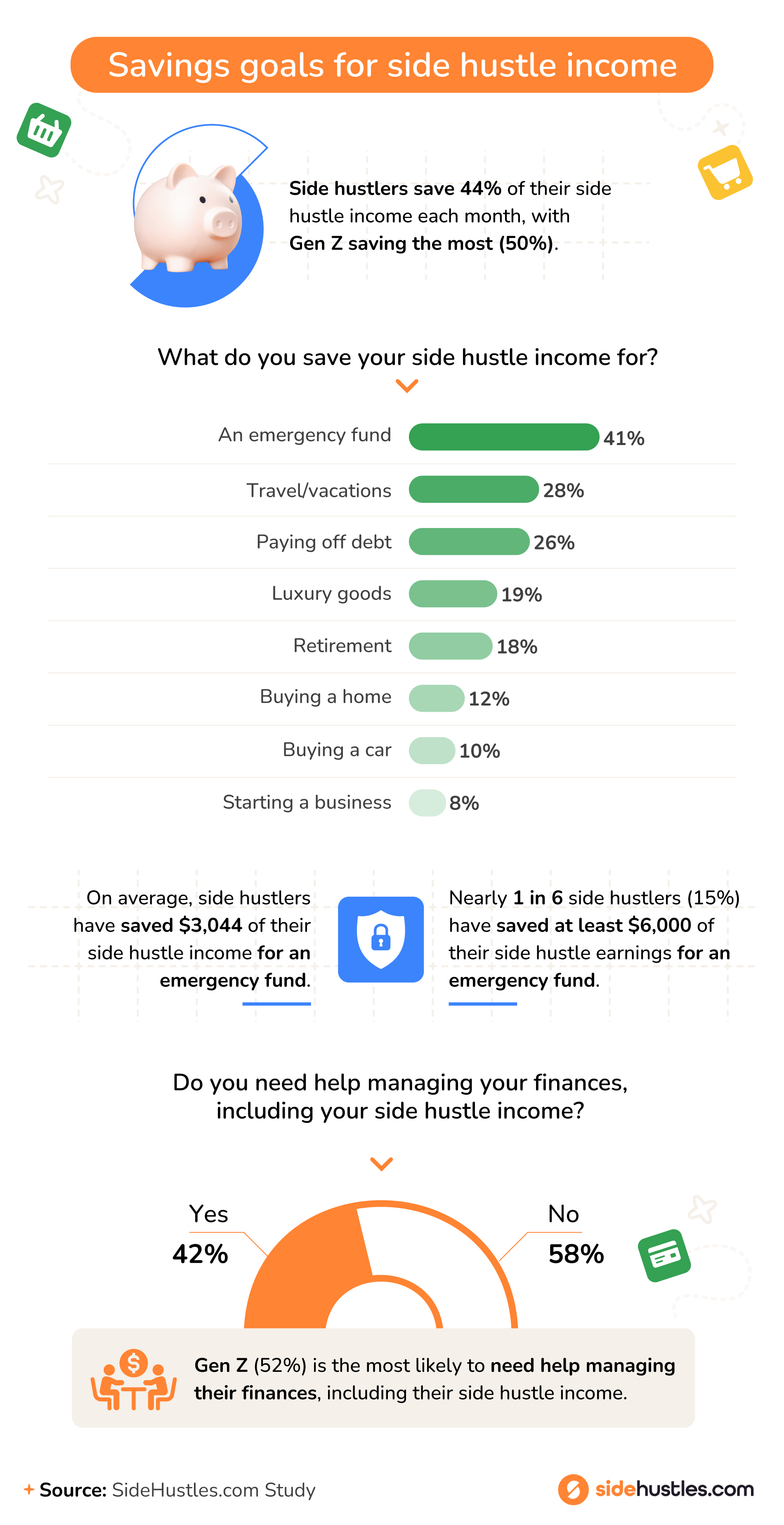

- 41% of side hustlers saving their extra income are doing so to build an emergency fund. Nearly 1 in 6 (15%) have saved at least $6,000.

- Side hustlers reported saving 44% of their side hustle income each month, with common goals including travel/vacation (28%) and paying off large debts (26%).

- Gen Z (52%) are the most likely to report needing help managing their finances, including side hustle income.